Table of content

- Comparing the Brisbane market with other property markets

- The Brisbane rental market also affects on how people buy and sell property

- Queensland investors started sharply selling homes

- The ghost of changes in Queensland land tax

- Interest rates go up and up again

- When will interest rates go down?

- Are Brisbane property prices falling?

- Investing in the Brisbane property market is still profitable in a long perspective

- General conclusion

Brisbane was the fastest-growing Australian property market in 2021, with numerous areas witnessing a house price increase of more than 30%.

Even as the growth rate decreased across Australia in 2022, Brisbane’s house price trend continued to remain robust in the first half of the year despite being hit by severe floods at the start of the year.

This only highlights the robustness of the Brisbane property market.

However, according to GM Law data in March-April 2022, the number of property transactions decreased sharply. Residents of Brisbane began to buy and sell property almost half as much. In this article, our GM Law team is trying to forecast the likelihood that the level of property transactions will return to March-April 2022 indicators.

Comparing the Brisbane market with other property markets

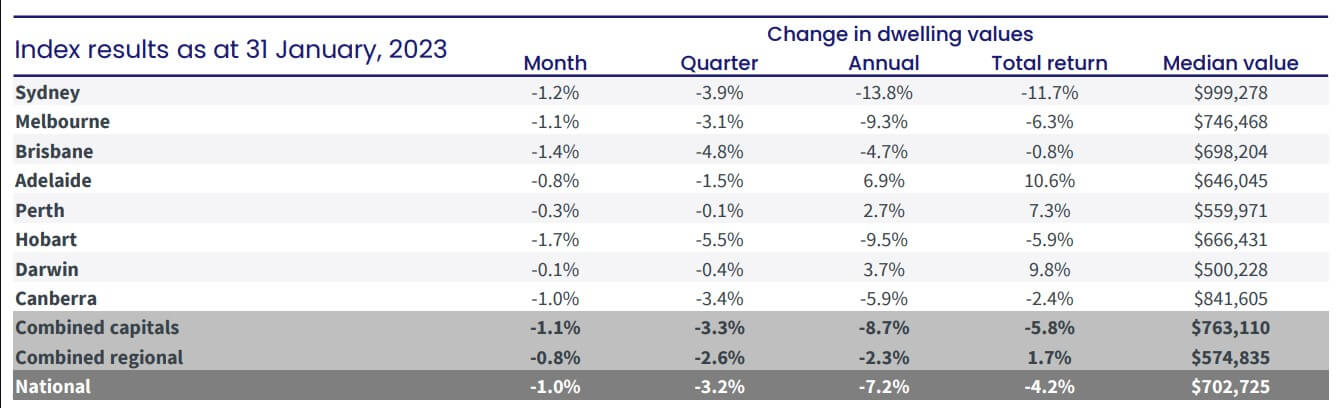

After reaching its maximum value in May 2022, CoreLogic’s national Home Value Index declined by 5.3% throughout the course of 2022.

Although the Australian real estate market as a whole is experiencing a slowdown, not all markets are being affected equally. As the chart shows, Brisbane has been less affected compared to Sydney and Melbourne.

This is not unusual, as more large markets tend to drop more, while the smaller ones like Brisbane are always much more stable.

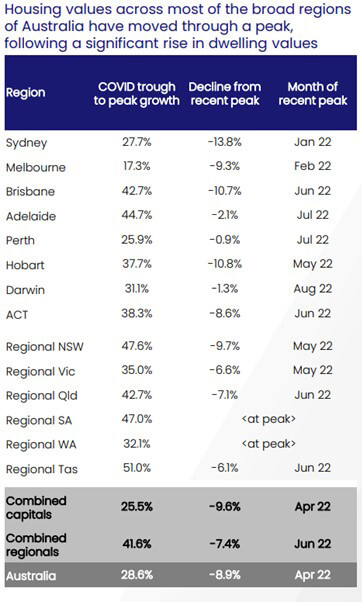

The table below illustrates the changes in dwelling prices across Australia since their peak. Observing the table, we can see that while dwelling prices in Brisbane and other capital cities experienced significant growth, the regional real estate market performed even better during the last property boom.

Currently, we are in the adjustment phase of the property cycle and overall property values have declined by 8% from their peak.

Experienced commentators are saying that this is not a property market crash, but a necessary correction that had to occur after house prices throughout Australia became overvalued.

The Brisbane rental market also affects on how people buy and sell property

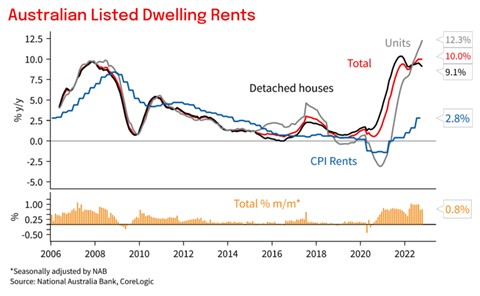

We are currently facing a rental crisis in Brisbane, characterized by an unprecedentedly low vacancy rate and rising rental costs. While property prices have surged, rents in Australia have also gone up by over 20% during the same time frame.

In September 2022, the national rental vacancy rate, which is the percentage of unoccupied rental properties compared to all rental properties, reached a historic low of 0.9%, the lowest it has been since April 2006 when it was 0.8% for one month. This persistently low vacancy rate has been sustained throughout most of 2022, a phenomenon not witnessed in the last two decades.

The high demand for rental housing leads to increased rents, resulting in the highest combined national rents (for both houses and apartments) on record, at $542 per week in November 2022.

One factor contributing to the growth in new households is the significant 17.1% increase in the number of single-person households between the 2016 and 2021 Censuses, largely due to relationship breakdowns and the dissolution of shared housing during the COVID lockdowns. This growth is in sharp contrast to the 7.1% increase in single-person households between the 2011 and 2016 Censuses.

The number of new residential dwellings has not kept pace with the formation of new households, growing by only 10.6% (approximately 198,000 new dwellings per year). This figure includes vacant residences, such as holiday homes or secondary properties.

Since the formation of new households is outpacing the growth in new dwellings, this creates increased demands on the housing market.

Data from CoreLogic shows that the number of rental listings, or properties available for rent, is almost 50% lower than the previous five-year average. In September of this year, there were 8,208 properties advertised for lease in Brisbane, significantly fewer compared to the five-year average of 15,995 properties.

What does this mean in terms of the Brisbane property market forecast? If Australia is experiencing a shortage of new homes and a post-COVID recovery in demand, this is pushing up rental prices. And if the rent is higher, then property owners may decide to rent out their property rather than sell it.

It is also obvious that the lack of households is temporary. Unlike factors such as global inflation (which we will discuss in more detail below), the property market quickly adapts to this aspect of the downturn. Moreover, Brisbane is characterized by a steady increase in the pace of new housing construction.

Queensland investors started sharply selling homes

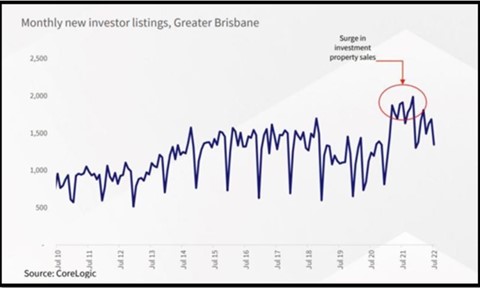

The shortage of housing can be attributed to several factors, but one significant factor is the sale of properties by investors seeking to capitalize on the record-high house prices.

According to a recent statement from the Chair of PIPA, Nicola McDougall, 45% of investors in Queensland sold at least one property in the last two years.

CoreLogic’s data also reveals a significant increase in the number of investment properties sold by investors during the period from July 2021 to July 2022.

This situation wouldn’t be as problematic if the properties were sold to other investors and re-added to the property market.

However, this was not the case, as most of the properties were instead sold to home buyers.

In essence, the sharp increase in Brisbane house prices has destabilized the real estate market. When 45% of properties are sold every few years, and then the situation is changing sharply, it shakes the system.

The ghost of changes in Queensland land tax

PIPA also reported that 19% of investors were contemplating selling their properties within the next year, with the primary reason changing to the Queensland Land Tax. However, these proposed changes were later abandoned by the Queensland Government.

The intended changes would have taken effect on June 30, 2023, and would have resulted in a higher land tax bill for individuals or companies who owned land in Queensland. Currently, Queensland land tax is calculated based only on taxable landholdings within the state, with a tax-free threshold of $600,000 for individuals and $350,000 for companies, trustees, and absentees.

The proposed changes would have required a Queensland landowner with non-excluded interstate land to have their land tax calculated at a higher rate, which could have added several thousand dollars to their annual tax bill.

What does this mean for buying and selling property in Brisbane? Such government solutions and then the repeal of laws against the backdrop of a jump in prices make investors want to “wait out the storm”. Yes, of course, there is always a Fear of Missing Out, which makes people sell faster, but it is more likely that this was another reason not to put the property on the market.

Interest rates go up and up again

The Reserve Bank of Australia raised the interest rate from a historical low of 0.10% per annum to 0.35% per annum on May 3, 2022, marking its first rate increase since November 2010. This was followed by eight more rate increases in the next eight months, with four 0.50% increases and four 0.25% increases, taking the cash rate to 3.35% as of February 7, 2023.

The increase in interest rates is largely due to inflation. In the past few decades, inflation was not a significant issue, but it has become more relevant in recent times due to a surge in inflation in many countries, particularly in the US.

In April, US inflation was at 8.3%, the highest level since the early 1980s, and inflation in the UK and 27 European Union countries is also at its highest level in decades.

Although Australia’s inflation rate at the end of March was 5.1%, which is lower than in many other countries, it still marked the highest level since the introduction of the GST in July 2000.

High inflation is unfavorable for consumers and households as it results in prices rising quickly, often faster than wages.

This situation provides an additional explanation for why July 22 saw a spike in selling among Queensland investors.

But you can’t play the inflation game for too long. Someone managed to buy property in Brisbane before their financial assets depreciated. Someone managed to profitably sell Brisbane properties while the market was at its peak. As we said above, mid-2022 was still the peak of the Brisbane property market. Many investors saw the situation in Sydney and Melbourne, so they understood that Brisbane was going to be in the same downturn soon, and they tried to quickly sell the properties.

When will interest rates go down?

Many experts in the US think, that the sharp cutting of interest rates early by the US Federal Reserve could have severe negative effects on the economy. Julian Emanuel, chief equity and quantitative strategist at Evercore ISI, warned that reducing rates in the near future could lead to inflation expectations becoming destabilized. He cited the example of the Burns Blunder in the 1970s, where Chair Burns cut rates in the midst of an economic surge in an attempt to combat a recession, resulting in another decade of inflation.

All this logic is extrapolated to the Australian market as well.

In other words, most likely, the interest rate won’t be reduced in the near future. Some Australian experts, like Michael Yardney, generally say that interest rates will be high until 2025. But there is reason to believe that they will stop rising so sharply. And this is much more important because it will lead to stability, which is critical for property buyers and sellers to re-enter the market.

It can be said that the current market is hovering in anticipation of stability.

Are Brisbane property prices falling?

It is predicted that Brisbane’s real estate prices will drop by 12% in 2023.

The estimated median house price for 2023 is $719,669 and the median unit price is $503,200. According to QBE, despite the substantial growth in 2020/21 and 2021/22, Brisbane is expected to remain reasonably priced compared to Sydney and Melbourne.

Investing in the Brisbane property market is still profitable in a long perspective

In recent years, Brisbane has consistently been regarded as the most promising real estate market in Australia, with high growth in 2021 and less decrease in 2022 in contrast to Sydney and Melbourne.

Many Australians are moving to Brisbane from Sydney and Melbourne, due to the lower property cost and the availability of affordable housing in desirable suburbs. This has resulted in a notable increase in internal migration to Brisbane and this trend is expected to continue in the coming years.

Commentators have said that, when compared to Sydney and Melbourne, it is possible to get more value for your money in Brisbane. The Federal government projects that Queensland’s population is expected to increase by over 16% by 2032 when Brisbane will host the Olympic Games. Also, the Olympic Games are always a magnet for property investors.

The population is expected to be centered in Greater Brisbane, which is expected to grow faster than the rest of the state with a rate of 1.9% in 2022-2023, compared to 1.4% for the rest of Queensland.

General conclusion

Now all the markets in Australia are not so much experiencing a fall as they are suffering from a sharp rise in 2021.

If we put aside all these numbers and statistics, then it is worth considering the thoughts of some property commentators as follows:

- Interest rates will probably not fall for a long time

- It probably won’t be as good as in 2021 for at least a few years

- By the end of April-May 2023, the market should probably calm down.

As for the GM Law specifically, back in December 2022, we drew attention to the growing interest of potential buyers in conveyancing services with a stable reduced demand for this niche in 2022. Simply put, people didn’t begin to settle more real estate contracts, but they became much more interested in this topic.

In 2023, we plan to keep updating this article to expand our understanding of what the commentators are saying the Brisbane property market will be like because it is critical for GM Law to understand how Australians will buy and sell property in the coming years. At the same time, we have more freedom in interpreting expert opinions, since we don’t influence people’s decision to buy or sell property and work only with that part of the market that has already decided exactly what they are buying or selling.

In addition, we are well aware that a significant part of our audience is real estate agents. Real Estate agents are at the coalface and as such we find their opinions matter as to what is happening in real-time.

So, what is the forecast for the Brisbane property? Will the Brisbane property market come back to March-April 2022 indicators? Let’s say, it’s good to be in Brisbane during this downturn (rather than in Sydney or Melbourne), but commentators are still saying that all participants of Australia property market will have to tighten their belts.